Age Verification that Protects

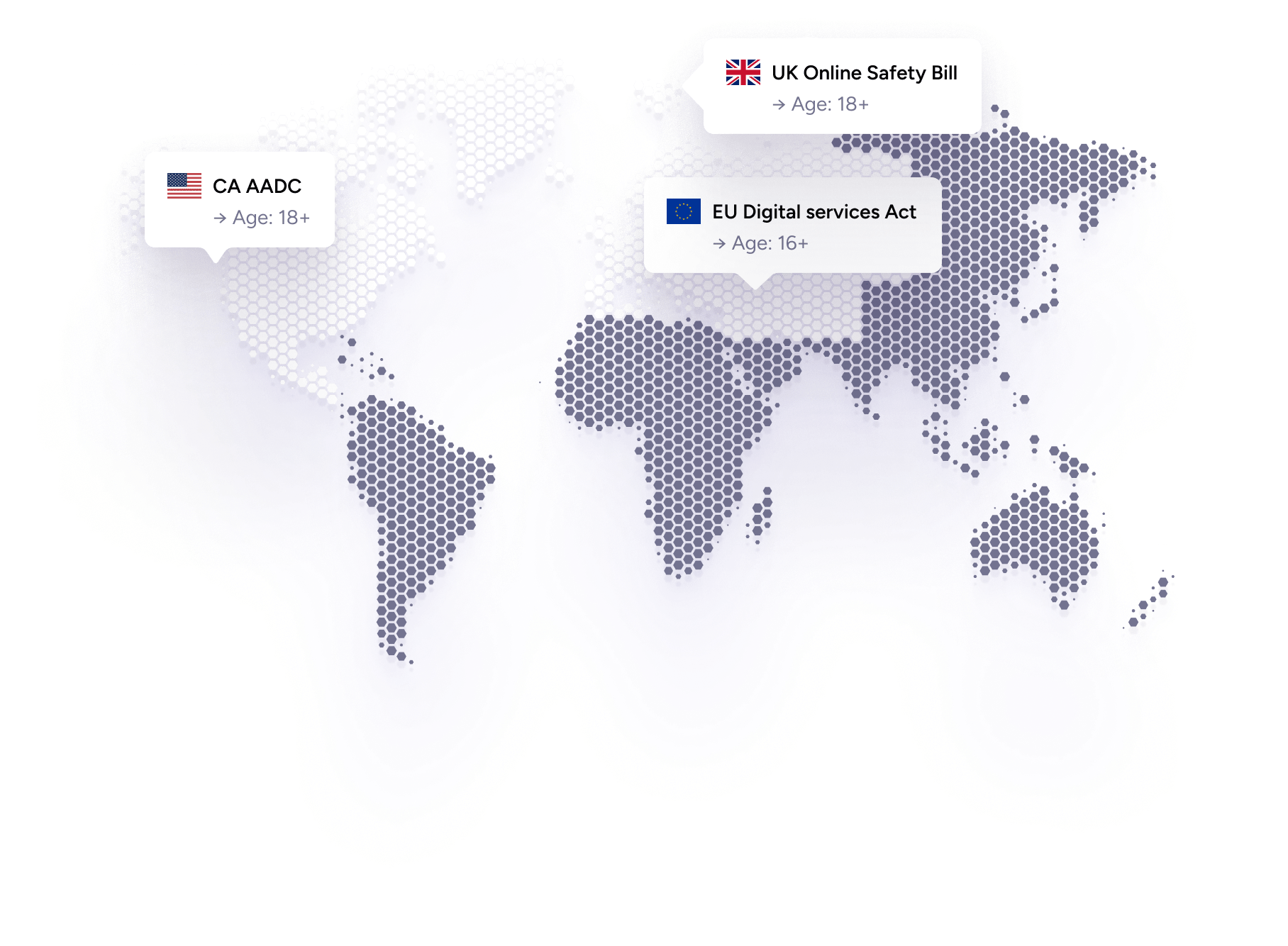

Comply with global age restrictions, prevent underage access, and ensure safer user experiences, all in seconds.Regulatory Fines Are Growing

Non-compliance with age laws can lead to major penalties and reputational damage, especially in gaming, crypto, and e-commerce.

Poor User Experience

Manual uploads or clunky flows cause friction and drop-offs. Your users expect it fast, mobile-first, and invisible.

One Rule Doesn't Fit All

Age limits vary by country, industry, and product, static systems won’t cut it anymore.

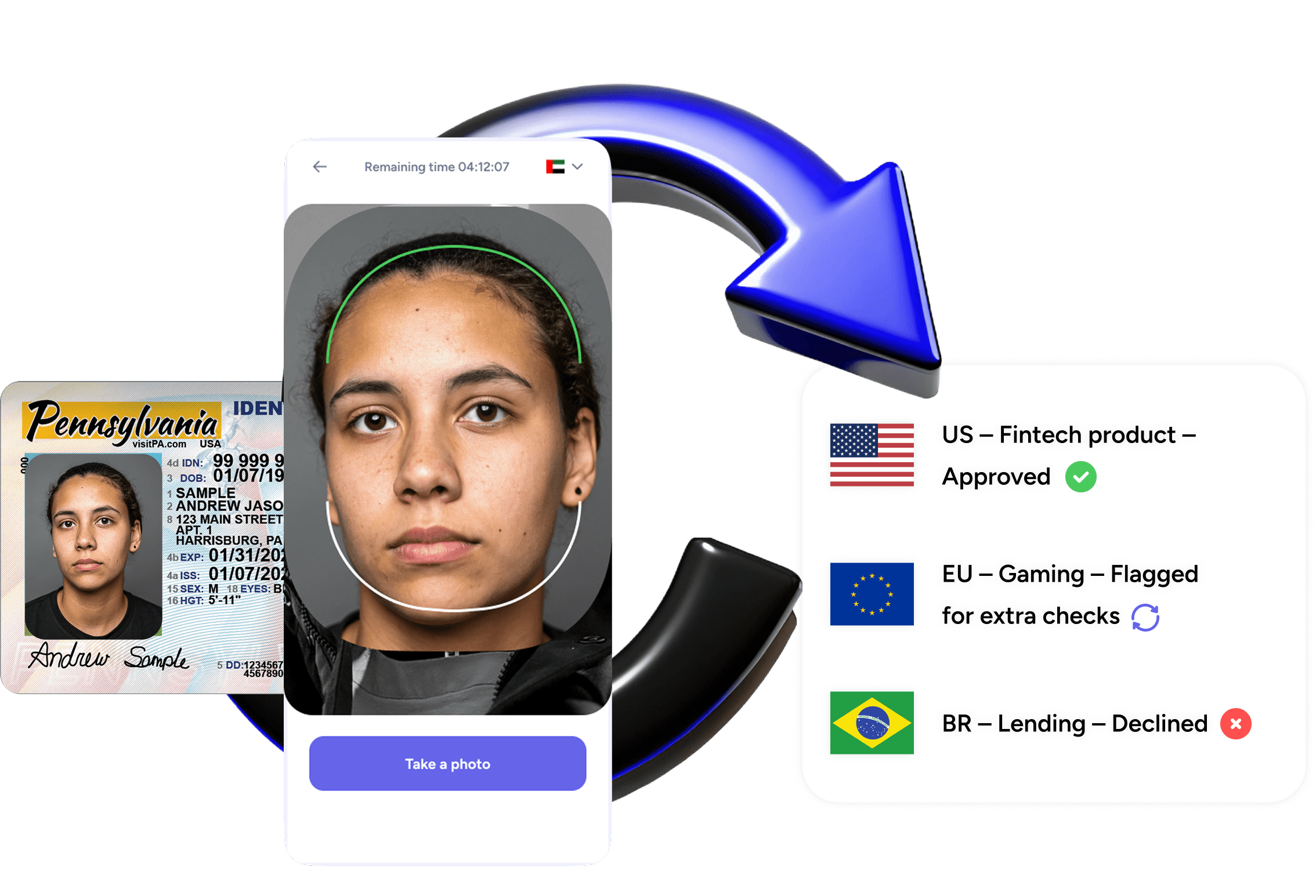

Smarter Age Checks, Done Your Way

For fintech, marketplaces, e-commerce, and adult platformsCombine document and facial checks to validate age, block

underage access, and stay globally compliant.

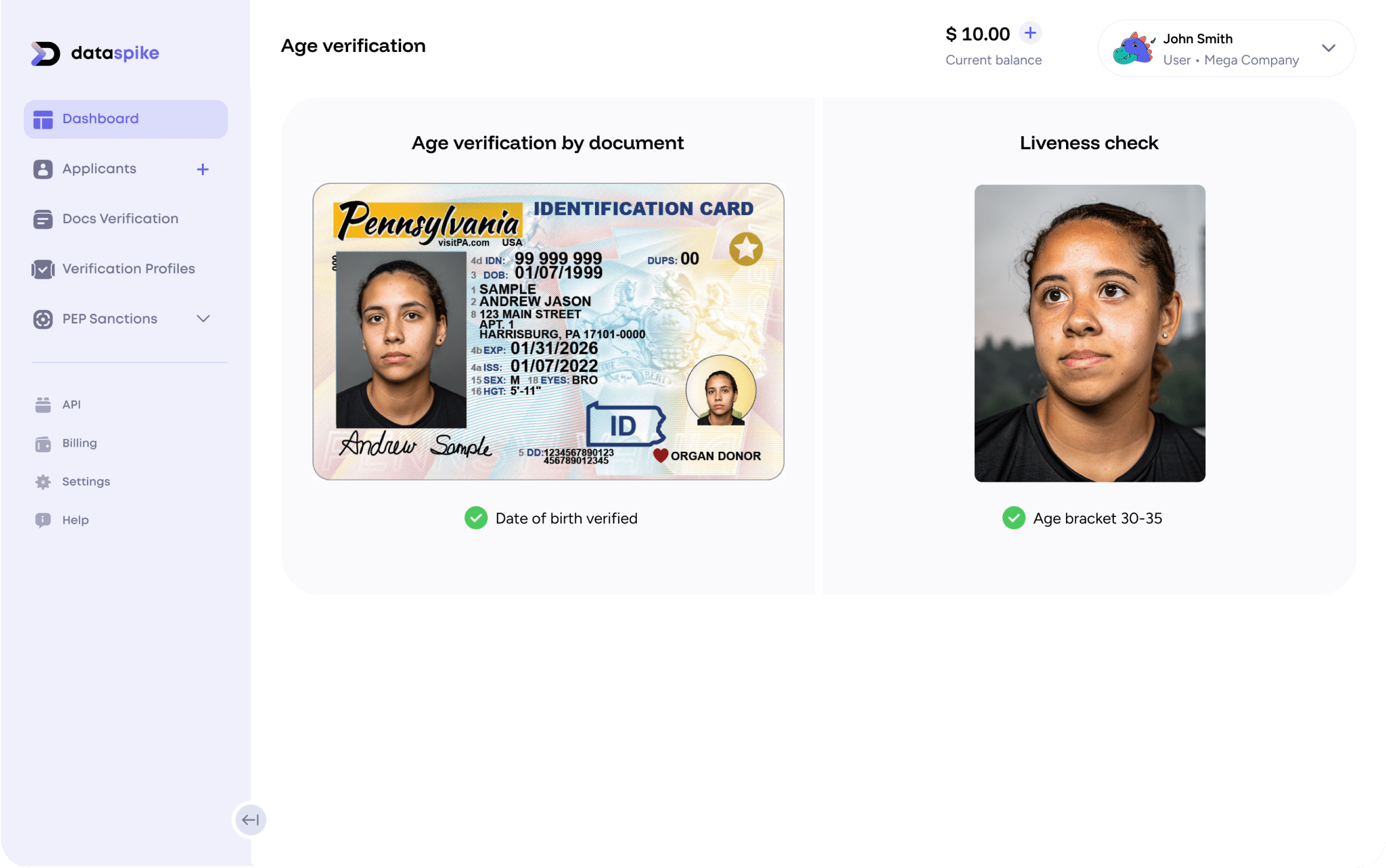

Real-Time Global Rules

Automatically apply the right age rule — whether it’s crypto in Dubai or gaming in Germany.Instant & Seamless UX

Use facial estimation or doc-based checks, get age results in seconds without disrupting the flow.Custom Policies, No Manual Work

Set age policies the way you want. Our engine enforces them live, with zero manual work.One Age Verification Platform— Multiple Ways to Use It

Pricing

Up to 2 years of monitoring. Free PDF reports (pay only for checks). Customizable risk scoring. Flexible pricing per query — one-off, ongoing, or applicant-based.

Customers about

Dataspike

Char Kong

Founder & Director Cloudian

International (Hong Kong)When we started working with Dataspike, it was immediately clear that they truly understood our challenges. They explained everything simply and to the point—no fluff. Their solution directly addressed our KYC and AML needs without adding unnecessary complexity.

Denis Gulagin

Bakksy, CEO&FounderWorking with Dataspike was a bless, quick and smooth integration resolved most (if not all) the questions we had with KYC processes, and their team was always there to support us along the journey.

Florian Huchedé

Co-Founder Carre.aiDataspike has been an excellent partner in enhancing data security and compliance. Their solutions are both reliable and easy to implement, making them a valuable asset for any business focused on risk managementReady to grow

your business?

Talk to us

Frequently asked

questions

Why Dataspike

1. Which documents are supported for Age Verification?

Passports, national IDs, driver’s licenses, and more — from over 190 countries.

2. Can I use this for age-restricted products like alcohol or crypto?

Yes. Our solution is widely used across industries with 18+ and 21+ age requirements.

3. Can I use Age Verification as part of a full KYC flow?

Absolutely. Age checks are part of our modular identity suite and work seamlessly alongside KYC.

4. Can I test the product before committing?

Of course. Use our sandbox environment or free plan — no card required.

Compliance & Customization

5. Is it possible to customize age limits per region?

Yes. You can set different age rules by country, product, or user group — we handle the logic.

6. Is this solution compliant with GDPR and other privacy laws?

Yes. We offer secure data processing and short-term storage options to meet global privacy requirements.

7. How does Dataspike handle minors who fail the check?

You decide: block access, request guardian consent, or flag the user for manual review.

8. How accurate is the date of birth extraction?

Our OCR engine is trained specifically for ID fields and reaches 98%+ accuracy on date of birth.

How It Works

9. How do I integrate with my product?

We support API, SDK, and JavaScript widget options — ideal for both low-code and enterprise setups.

10. Is there a dashboard for reviewing age verification outcomes?

Yes. You’ll see logs, reports, and real-time verification results in our admin panel.

,

, ,

, ,

,