Financial Compliance 101: Glossary

This publication is dedicated to the basic concepts of financial compliance, such as KYC, AML, and others. We are going to start from the basics: compliance itself and Know Your Customer procedures.

Compliance

Compliance means conforming to rules, regulations, standards, or laws. In finance, compliance includes various procedures designed to prevent money laundering and financing of illegal activities, which include but ain’t limited to terrorism, proliferation, or human trafficking. The respective area of regulation is often referred to by the abbreviation AML/CTF, or Anti-Money Laundering and Counter-Terrorist Financing.

KYC

The first essential step in the AML/CTF framework is the KYC, or Know Your Customer, procedure. To identify new customers, financial companies (such as banks, fintech firms, payment providers, and so on) request an identity document (such as a passport) and other papers that provide basic information about the person. The KYC procedure may include filling out a form, proof of address check, and so on. The information acquired during KYC enables companies to run customer due diligence and establish a risk profile. Some additional checks may be complete: the identity of a potential customer may be checked against the lists of Politically Engaged Persons, sanctioned individuals, or open legal databases.

eKYC

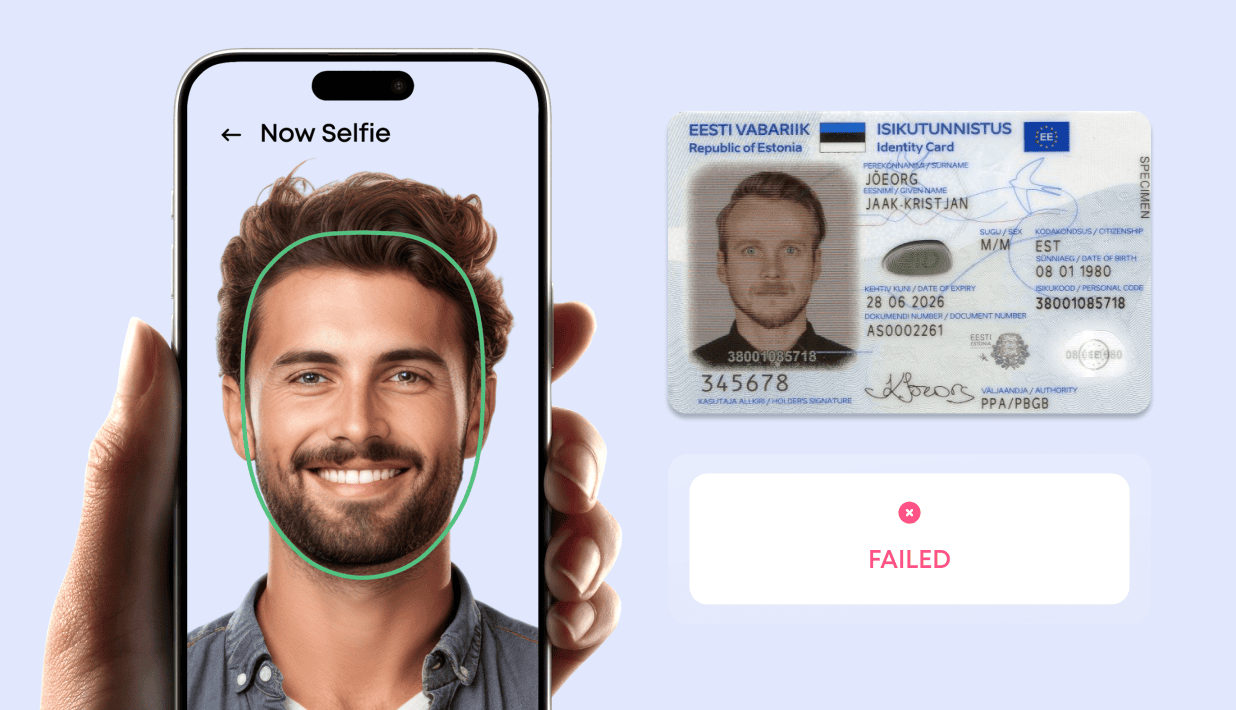

eKYC or electronic KYC refers to different forms of KYC automation. For instance, many fintech apps and neobanks provide a mobile-first onboarding experience: a customer is required to take a photo of an ID, a selfie with an ID, and complete a Liveness test (perform several actions on camera, such as turning head or smiling). The information is captured from an ID using optical character recognition (OCR), the selfie allows verifying the ownership of an ID, and the Liveness test validates that no photomontage or deepfake was used. More sophisticated examples of eKYC include extracting digital data from the government-issued smart ID. For instance, Estonians can use their eIDs for over 600 government services and any legal interaction within the country, including opening accounts in financial institutions. India’s Aadhaar eID system is one of the most prevalent in the world, registering more than 1.29 billion people. Aadhaar-based eKYC allows financial or telecommunication service providers to verify the identity of Indian customers online and offline. Electronic KYC has significant benefits over the paper-based approach. It’s faster, more convenient, and less prone to human bias and mistakes.

KYB

Know Your Business, or KYB, is an equivalent of the KYC procedure for sole proprietorships and legal entities. The company may be required to provide its constitutional documents, information on beneficial owners and their identification documents, business licenses, etc. The KYB procedure aims to verify that the company is legitimate (and isn’t a shell company) and its owners ain’t included in the sanction and PEP lists.

KYCC

Know Your Customer’s Customer, or KYCC, is an additional compliance measure beyond regular KYB. As a part of KYCC, the companies may be required to provide information about their own customers and partners. KYCC may help to identify fraudulent activities proactively but greatly increases the compliance burden for financial institutions.

KYC and compliance

Any company can implement KYC procedures for good. However, some industries are subject to specific regulations and must enforce strict AML policies, including KYC, transaction monitoring, and so on. KYC is obligatory for financial companies (banks, fintech, payment providers), marketplaces, luxury services and goods, gambling, cryptocurrencies, and more. KYC works as a robust protection against many kinds of financial crime. Basic steps, such as ID check and proof of address check, drive away potential fraudsters while continuous monitoring helps identify suspicious activities and prevent them. KYC isn’t a magic pill but a measure that enables companies to implement strong AML policies.

KYC beyond compliance

Even though KYC is a legal requirement for some companies, its benefits go far beyond mere compliance. Detailed customer onboarding, continuous monitoring, and the smart use of information collected give the companies the upper hand in the competition. In the context of customer relations management, the information collected via customer onboarding (including KYC) allows for building comprehensive customer profiles and offering products and services tailored to customer needs. A better understanding of customers opens cross-selling opportunities and helps to improve sales and marketing processes.

KYC is also an invaluable source of information for data analysis that can provide many insights into the customer behavior, market trends, and potential risks.

Follow #DataSpike for insightful updates in KYC and financial compliance!