Smart Document Verification

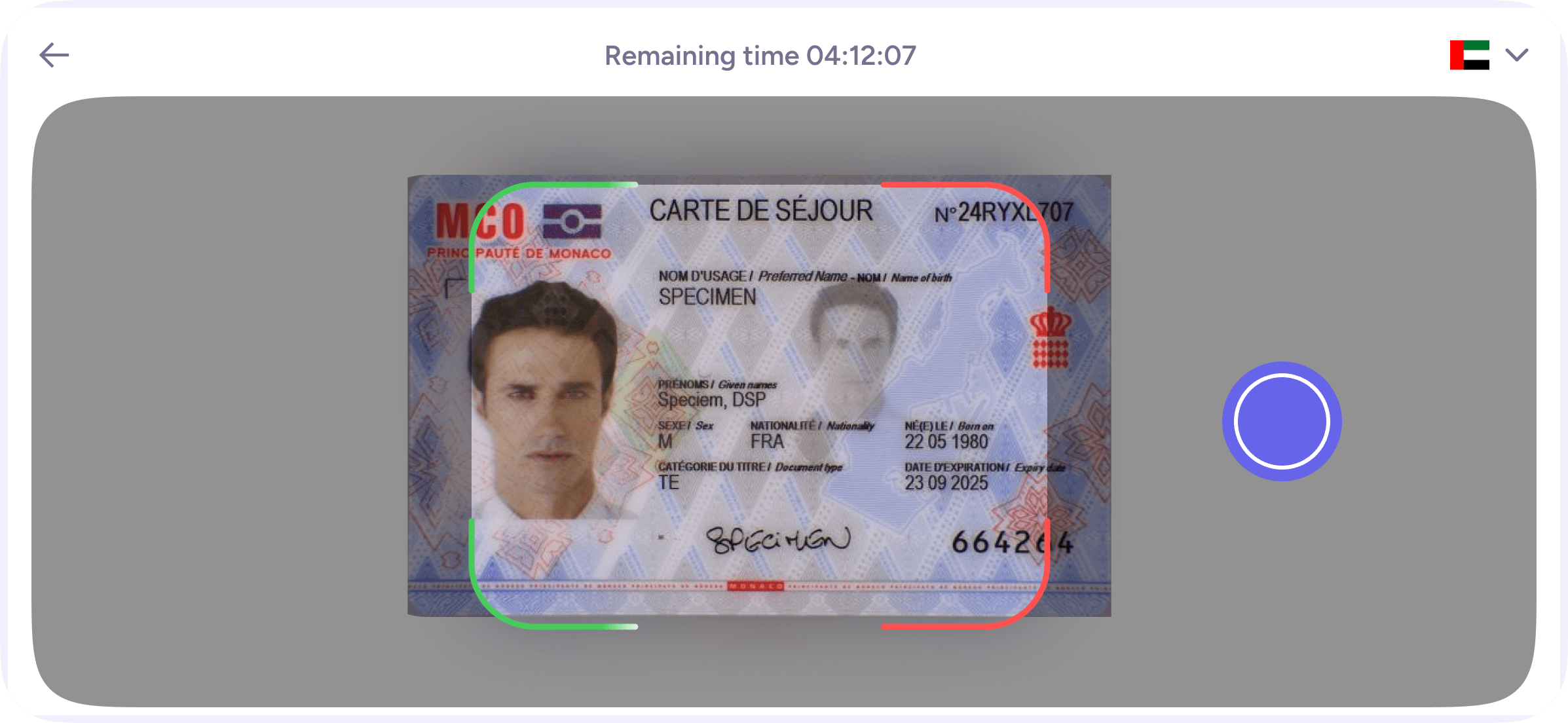

Screen documents in seconds and stay ahead of fraud.Fraud and fake documents

Forged or expired IDs can slip through - putting you at regulatory and reputational risk.

Compliance complexity

Ever-changing AML/KYC rules across countries make document verification hard to manage in-house.

Rigid Contracts, Minimal Support

Enterprise vendors often lock you into long contracts - but deliver slow support, no flexibility, and minimal willingness to adapt to your use case.

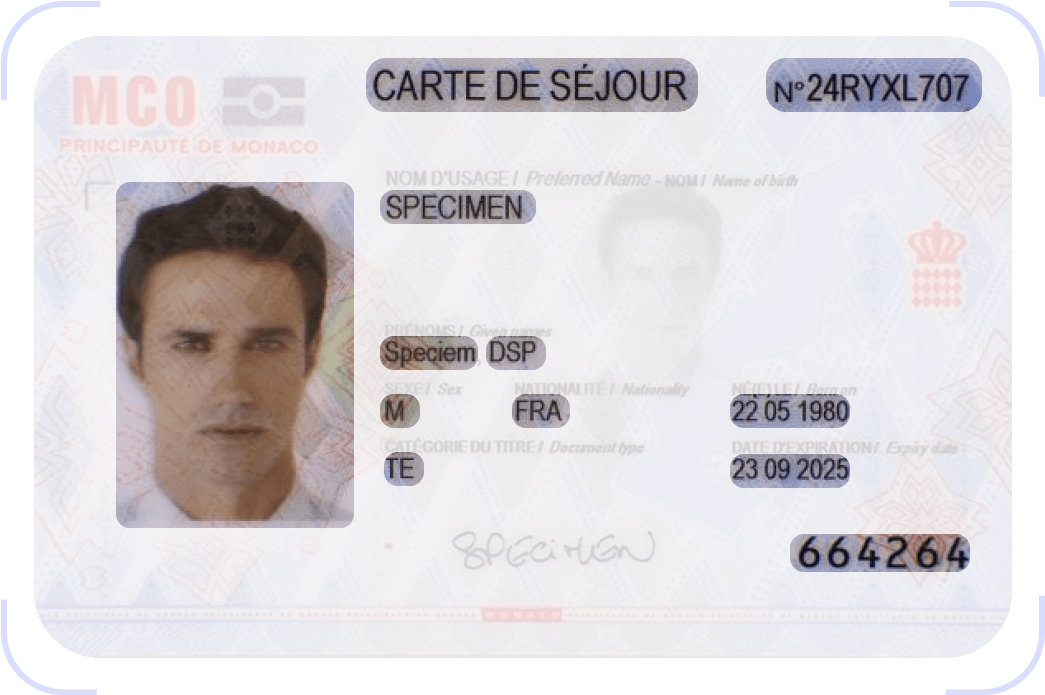

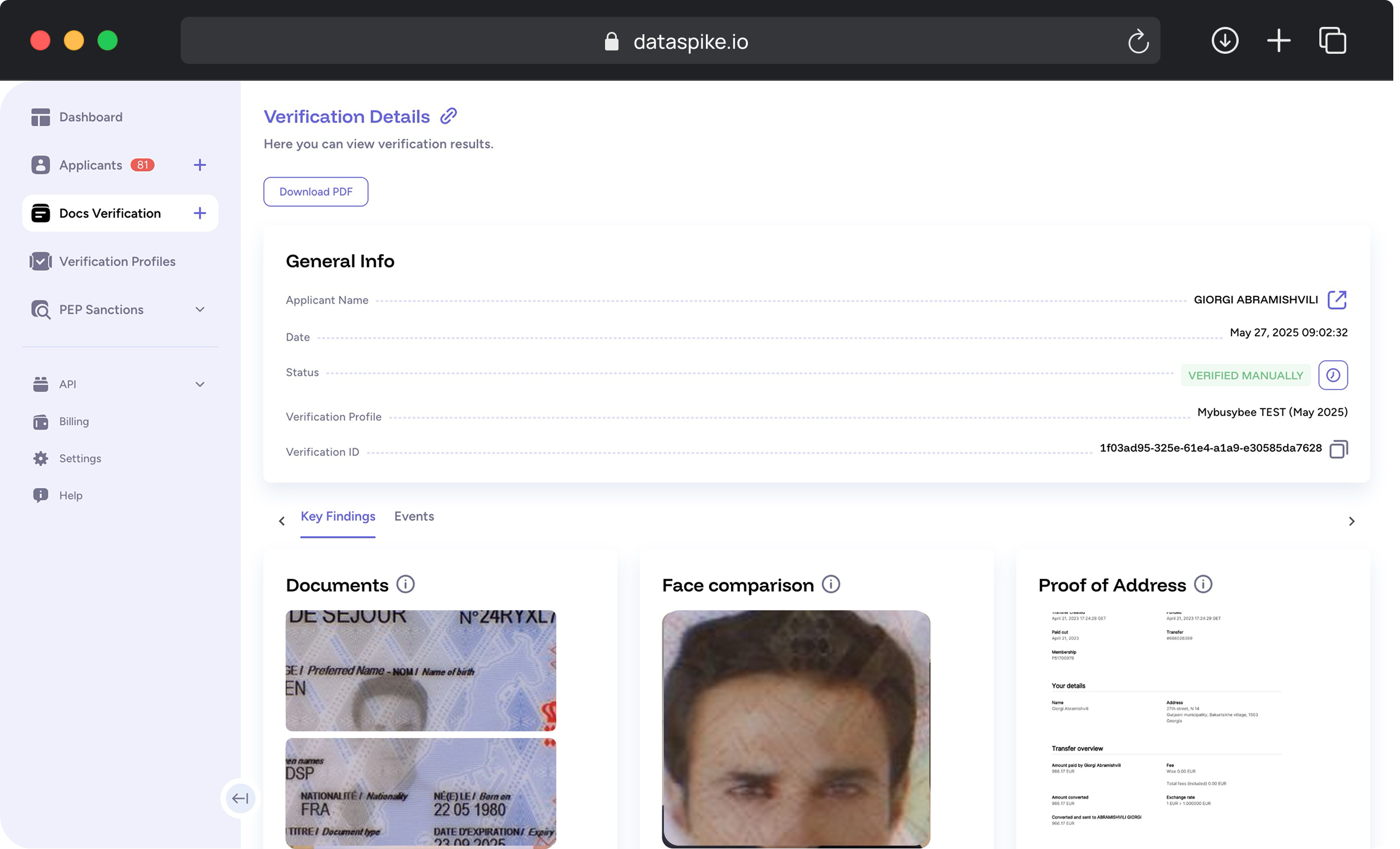

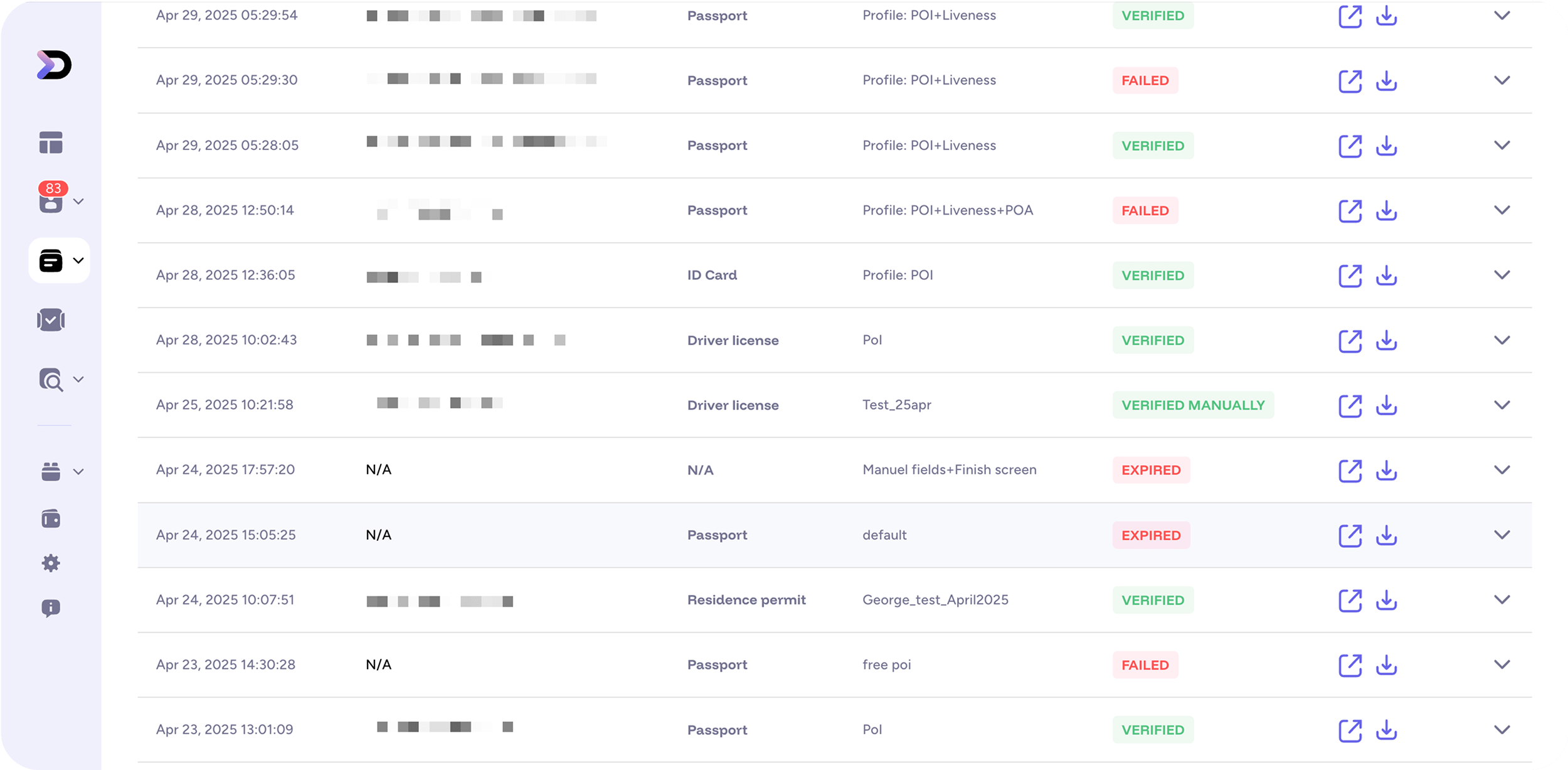

Instant, Global Document Verification Solution

Ensure real customers with verified documents

160+ Countries Supported

ID cards, passports, visas, and licenses - ready to verify instantly.150+ Verified Data Sources

PEP, local sanctions lists, and global watchlists - always up to date.3-Second Document Check

Speed up onboarding without sacrificing compliance or UX.One Document Verification Platform— Multiple Ways to Use It

Pricing

Up to 2 years of monitoring. Free PDF reports (pay only for checks). Customizable risk scoring. Flexible pricing per query — one-off, ongoing, or applicant-based.

Customers about

Dataspike

Char Kong

Founder & Director Cloudian

International (Hong Kong)When we started working with Dataspike, it was immediately clear that they truly understood our challenges. They explained everything simply and to the point—no fluff. Their solution directly addressed our KYC and AML needs without adding unnecessary complexity.

Denis Gulagin

Bakksy, CEO&FounderWorking with Dataspike was a bless, quick and smooth integration resolved most (if not all) the questions we had with KYC processes, and their team was always there to support us along the journey.

Florian Huchedé

Co-Founder Carre.aiDataspike has been an excellent partner in enhancing data security and compliance. Their solutions are both reliable and easy to implement, making them a valuable asset for any business focused on risk managementReady to grow

your business?

Talk to us

Frequently asked

questions

Why Dataspike

1. What is Document Verification and how does it work?

Document verification is the process of checking whether a government-issued document (such as an ID or passport) is real, untampered, and belongs to the person who submitted it. Dataspike verifies document authenticity, extracts key data, and returns a decision instantly.

2. Which documents and countries are supported?

We support passports, national ID cards, and driver's licenses from over 200 countries. Our database includes the most commonly used document types across fintech, crypto, and regulated industries.

3. How fast is the verification process?

Most documents are processed in under 3 seconds. The entire workflow is automated — no manual review required.

4. Can I use Document Verification without writing code?

Yes. You can create verification links from the dashboard or embed our no-code widget on your site — no development needed.

Compliance & Security

5. How accurate is your Document Verification system?

Our in-house AI models are trained on millions of samples to detect forgery, formatting issues, and data mismatches. We continuously retrain for better accuracy.

6. Do you extract data from the document?

Yes. Using Optical Character Recognition (OCR), we extract fields like full name, date of birth, document number, and expiration date.

7. Can you detect fake or tampered documents?

Absolutely. Our system checks for digital edits, template mismatches, visual anomalies, and inconsistent metadata — all in real time.

How to Integrate

8. Is your solution KYC/AML compliant?

Yes. Our verification engine helps businesses meet global KYC and AML regulations by validating user identity and flagging potential fraud.

9. Is there an API for integration?

Yes. Our developer-friendly API lets you fully integrate document verification into your onboarding flow, CRM, or compliance systems.

10. Do you store documents and how is data protected?

Documents are stored securely in compliance with GDPR and ISO 27001. You control data retention settings, including auto-deletion options.

,

,

,

, ,

,